AIR TRANSPORT Air bridges and Covid-19

In for the longest haul

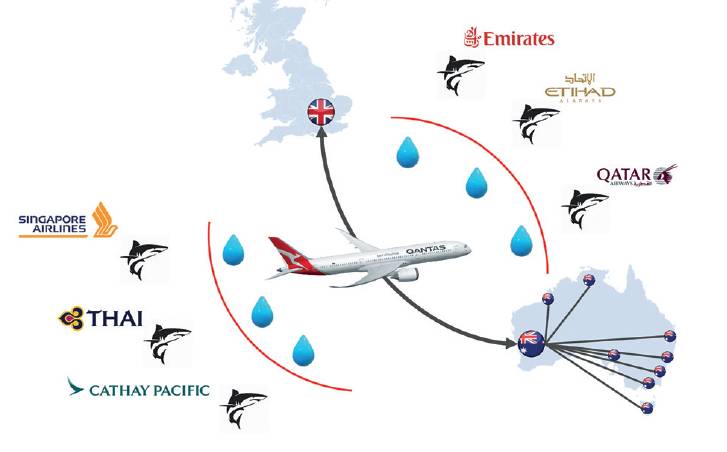

Blue ocean strategy in the post-Covid-19 era

LINUS BENJAMIN BAUER (Founder and MD) and DANIEL BLOCH (Principal) from Bauer Aviation Advisory report on the potential of air bridges and a ‘blue ocean’ ultra-long-haul strategy to connect low-infection areas of the world.

Qantas

Qantas

The implications of Covid-19 has sent shockwaves throughout the aviation industry, sending a myriad of liquidity strapped airlines across the globe into administration or part government ownership (Bauer, Bloch and Merkert, 2020). Perhaps most indicative of this, global flight capacity has been slashed by up to 90%. To this end, the International Air Transport Association (IATA) has recently released a new set of revised figures that predicts, as a direct result of the coronavirus, the sector will be forced to incur losses between $248bn – $260bn.

In turn, the inherent uncertainty levels that are synonymous with current times have left a wide array of airlines struggling to navigate uncharted territories. As a result, there is an urgent and existential call for action across the entire value chain of the sector, which must be founded on the basis of strategic creativity, prioritising human health factors, sustainability and profitability all in tandem.

In light of this, various clients, executives, industry professionals and trade journalists have come forward with the following questions:

- How do we collectively create demand during a recovery phase, rather than fighting over what exists?

- How and why might genuine cost leaders or differentiators be able to cope better with that challenging situation?

- Are there new ways of thinking or approaches in existence that could upend traditional thinking about aviation strategy?

- What are the core requirements for strategic success in the post-Covid-19 era?

- What kind of emerging business models, with blue ocean potential, could be accelerated by Covid-19?

Let’s try to shed some light on these questions. Most strategists at airlines around the world will agree that business is all about making hard decisions, in the midst of crucial and often binary trade-offs, that hold vastly different pathways ahead. The economist and business strategist Michael Porter breaks down the choices that companies must make by claiming that successful firms will either take up a position of price leadership (eg low-cost carriers) or product differentiators (eg full-service network carriers). As such, those who fail to identify themselves within one or either bracket often encounter difficulties in ascertaining a competitive advantage, which only becomes further accentuated in a time of crisis.