However, the pandemic had also had the effect of bringing the aerospace (and other industries) together to work on joint projects previously never thought of – such as the UK Ventilator Challenge where major aerospace companies collaborated with companies in the automotive industry to create medical ventilators for the NHS. “Adapting production and working with other industry sectors on the Ventilator Challenge has shown the real spirit of the aerospace industry rising to do the seemingly impossible,” said Dick Elsy, CEO, High Value Manufacturing Catapult. He explained how the collaboration between the aerospace and automotive sectors was offering the possibility of co-operation in other areas, such as the development of battery technology.

Covid-19 has also changed ways of working and attitudes to new ideas. “Industry doesn’t respect tradition, it respects innovation,” declared Hugh Milward from Microsoft, who then went on to explain how the UK had seen between two to ten years’ worth of technical transformation happening in only two months.

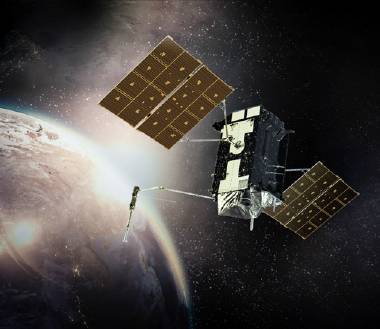

Countdown to UK space launches

At a session on UK spaceports, there was much excitement about the first-ever orbital space launch for British soil, set to be in 2022 from Spaceport Cornwall. This will see Virgin Orbit use a modified Boeing 747 to air-launch a pathfinder payload, using its Launcher One rocket.

THE UK HAD SEEN BETWEEN TWO TO TEN YEARS’ WORTH OF TECHNICAL TRANSFORMATION HAPPENING IN ONLY TWO MONTHS.

Andrew Kuh, Head of International Spaceflight Policy, UK Space Agency, revealed that a key US-UK agreement, in the form of the Technology Safeguards Agreement had now been signed, which removed a major obstacle to US space companies bound by MCTR and ITAR technology regulations. This treaty (which still needs Parliament to approve) now means that US companies will be able to launch from UK soil. Some operational 'overheads', such as US-only secure areas, will still be required and operators will need both FAA and UK launch licences – though mutual recognition is planned.

With this capability (which also includes other spaceports in the UK), the UK is aiming to beat rivals to be the first Western European country to offer direct access to orbit from its soil in a new commercial space race.

JetZero 2050 target focuses minds

Despite the aviation sectors' current woes, it was clear that sustainability was one of the major themes during the week. The UK's clear commitment to zero-carbon aviation by 2050, and even a long-haul zero-carbon airliner within a generation, thus helped focus minds on this target. The week saw the first meeting of the UK's high-level JetZero Council, chaired by the Prime Minister himself, an example of the priority now given this goal.

There was therefore much discussion of disruptive technologies, the potential of hydrogen and the pathway to zero-carbon aviation. However, a phrase that came up in more than one session was that there is 'no silver bullet' to achieve this goal and it would take a mix of technologies and operational procedures to achieve this. Consultants Roland Berger, for example, said that the aviation industry could get to 50% of 2050 green targets just with better ATC/airline efficiency, switching to next-gen conventional airliners (A321neo, A350, 787) and trajectory optimisation – with the other 50% by sustainable aviation fuels (SAF) and electrification.

Rolls-Royce's CTO, Paul Stein, echoed the potential of SAF, saying that they were one of the biggest games in town and that "beyond 600-1000miles, most next-gen technologies run out of steam". However, he stressed that progress had not slowed down with the UltraFan future engine and that there was a host of disruptive, green technology for smaller eVTOLs, commuter and GA aircraft that was being developed. The potential of hydrogen, too, as an zero-carbon energy source (especially 'green hydrogen', made from renewable power) came up several times during the week – with Airbus revealing it was working to mature this technology. However, the volume requirements of hydrogen compared to kerosene means that airframes will have to be designed at the outset to take advantage of this fuel.

The flip side of this acceleration of sustainable aviation, is that the OEM's customers are now fighting for their very survival due to Covid-19 and are in no position to buy radical new aircraft or more expensive SAF fuels. Airbus CTO Grazia Vittadini acknowledged that the crisis would likely delay new airliner launches: "We have seen a shift to the right of possible entry points of technology we are developing but the overall ambition does not change."

Can Europe afford two fighter programmes?

While the Italian/Swedish/UK Tempest fighter project generated headlines this week, a Flight Global webinar panel looked more widely at the issue of European fighter requirements and whether Europe (including the UK) could afford to run two competing fighter programmes. In a recent RAeS Sopwith Lecture, Airbus Defence and Space chief Dirk Hoke reiterated the call for a merged European next-generation fighter effort to avoid the mistakes of the past. However, speaking in the webinar, Douglas Barrie, Senior Fellow, Military Aerospace at the IISS, noted that with a merged single effort: “The problem at European level (including the UK) is that half the sector loses out and for those countries that lose out that is very very damaging.” Meanwhile, Teal Group's Richard Aboulafia, quipping about Paris' love of 'Franco-French' defence industrial co-operation, asked what would be left for others in European FCAS once Dassault, Safran and Thales had been allocated work. He said, is that Tempest is viewed, at least in the US, is a “far more international, far more global product”.

Urban Air Mobility Summit

The Thursday of the virtual show included an all-day global urban air summit GUAS 2.0 on the latest progress on the development of urban air mobility (UAM). Following on from the first event, GUAS, which was held at Farnborough in September 2019, this year’s on-line conference featured presentations from many of the key players helping to shape the future of this emerging future aerial transport system – including: Boeing NeXt, Lilium, Uber Elevate, Ehang, Future Flight, the FAA, Vertical Aerospace and EmbraerX. A wide range of topics were discussed covering not just the new eVTOL vehicles under development but also the wider ‘ecosystem’ of vertiports, air traffic management, internal and external systems, regulations, safety, certification, environment and social factors.

One surprising conclusion made by the speakers was that the onset of Covid-19 has not had such a negative effect on the development of UAM than might be expected. While new entrants to the UAM market are experiencing problems with obtaining finance, those companies which already have projects in development are continuing to make progress.

Summary

This week then has hammered home what unprecedented times we are living in. While many people have previously joked that flying displays were on their way out at Farnborough as tighter airspace restrictions and dearth of new aircraft reduced the flying display, no one seriously expected that this year, 2020s biggest aerospace trade show would be cancelled outright. With the pandemic raging, airlines fighting for survival and OEMs downsizing, good news stories are thus few and far between. However, the discussion and debate around future technology, whether it be sixth generation fighters or urban air mobility, gave grounds for optimism – even though this pace of change is being forced upon the industry. This 'virtual' Farnborough did in fact show that, however much the grumbling, deep down, the real air show is extremely valuable for the global industry. It will therefore be a critical barometer of health as the global aerospace resets and recovers.

The FIA Connect opening ceremony saw a VIP panel of top aerospace leaders, chaired by Peggy Hollinger, Industry Editor Financial Times (top left). Clockwise Guillaume Faury, CEO Airbus, Charles Woodburn, CEO BAE Systems, Victoria Foy, CEO, Safran Seats GB, Tony Wood, CEO, Meggitt, Alessandro Profumo, CEO Leonardo and Jacqui Sutton, CCO, Civil Aerospace, Rolls-Royce. FIA Connect

The FIA Connect opening ceremony saw a VIP panel of top aerospace leaders, chaired by Peggy Hollinger, Industry Editor Financial Times (top left). Clockwise Guillaume Faury, CEO Airbus, Charles Woodburn, CEO BAE Systems, Victoria Foy, CEO, Safran Seats GB, Tony Wood, CEO, Meggitt, Alessandro Profumo, CEO Leonardo and Jacqui Sutton, CCO, Civil Aerospace, Rolls-Royce. FIA Connect