AEROSPACE digital transformation

Becoming digital

The digital race is on – and first movers are already well out in front. LUC ESMERIT, PASCAL FABRE, GERRIT LOOTS, NITIN MAHESHWARI, and MATTEO PERALDO examine progress so far.

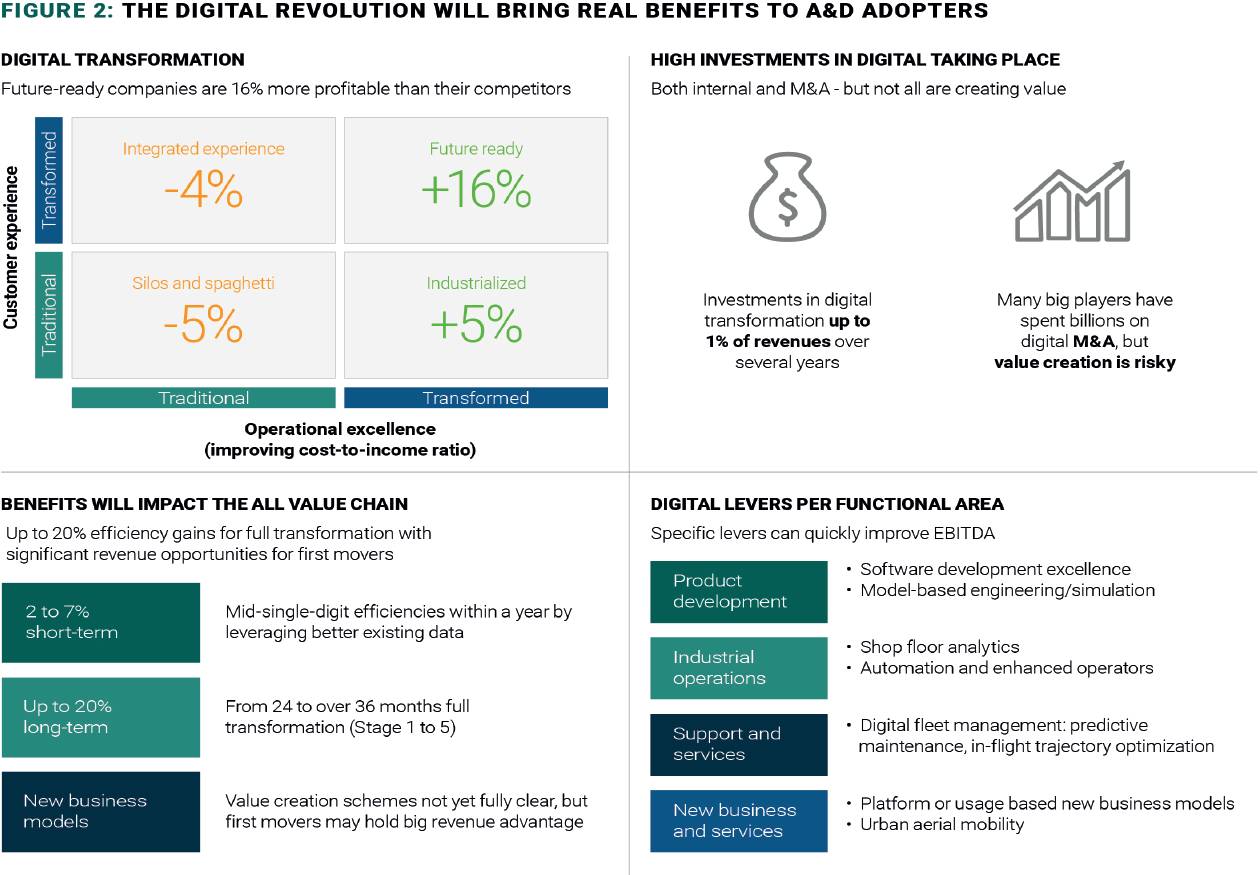

Companies in nearly every industry are furiously engaged in digital transformation initiatives. For good reason: digitally-transformed companies are already 16% more profitable than their peers – and stand to increase their advantage in coming years – according to joint research by AlixPartners and the MIT Center for Information Systems Research. Just as important, digitally-transformed companies position themselves for sustained success in an environment where data is by far the most valuable asset a company can control.

The aerospace and defence (A&D) sector is no exception to the transformation trend. Digital transformation is spurring significant investment by A&D players, including the sector’s two biggest deals in recent years, the combination of the aerospace businesses of United Technologies (UTC) and Raytheon, announced in June and valued at $52bn, and UTC’s $30bn acquisition of Rockwell Collins in 2017. The acquisitions enable UTC to apply its digital expertise to Raytheon’s portfolio of defence hardware and software and give UTC access to more than 71% of the data generated by a Boeing 787 system, according to Aviation Week – data that UTC is analysing and combining to improve operations, create new value at every stage of the aircraft lifecycle, and counter Boeing’s recent push into aftermarket services, which it aims to build into a $50bn annual business by 2022.

The drive for digital is also spurring many companies in the UK’s aerospace sector – the world’s second-largest after the US, with $46bn in annual turnover – to step up their innovation initiatives. Although uncertainty around the UK’s planned exit from the EU has muted cross-border merger-and-acquisition (M&A) activity, several of the country’s own aerospace stalwarts, including BAE Systems, GKN, Rolls-Royce and Ultra Electronics, are pursuing innovation and technology acquisition through alternative avenues, including venture capital investments, joint ventures and innovation centres. Non-domestic players with large UK footprints, such as Airbus Group, Boeing, Bombardier, Lockheed Martin and Thales, are following suit. Each of those companies is forging links with other aerospace players to promote the sharing of data to bolster the efficiency and effectiveness of their digital innovation programs. Their avid pursuit of collaborators underscores the vital importance of data ecosystems to digital transformation. In the digital age, no company, no matter how dominant, can stand alone.

For the most part, digitally transforming companies in the UK seek to shore up their core strengths in propulsion systems, aerostructures, advanced avionics systems, and cybersecurity software and electronics, for which UK aerospace companies are well known. Their thinking is that by building their digital capabilities they can differentiate themselves and create value through digital engineering, AI-assisted design and customer service, augmented reality and additive manufacturing (socalled 3D printing).

For the most part, digitally transforming companies in the UK seek to shore up their core strengths in propulsion systems, aerostructures, advanced avionics systems, and cybersecurity software and electronics, for which UK aerospace companies are well known. Their thinking is that by building their digital capabilities they can differentiate themselves and create value through digital engineering, AI-assisted design and customer service, augmented reality and additive manufacturing (socalled 3D printing).

Yet for all the buzz around digital transformation, many companies appear to be so focused on dayto-day business that they have not made time even to begin their transformation journeys. Only 23% of companies have made the jump to digital operations, according to the AlixPartners-MIT research, and fewer than half the companies surveyed have started to apply digital data technologies to improve operations or the customer experience. Unlike transformed companies, these digital laggards still view data as merely an operational output and leave most of its value-creating potential untapped.

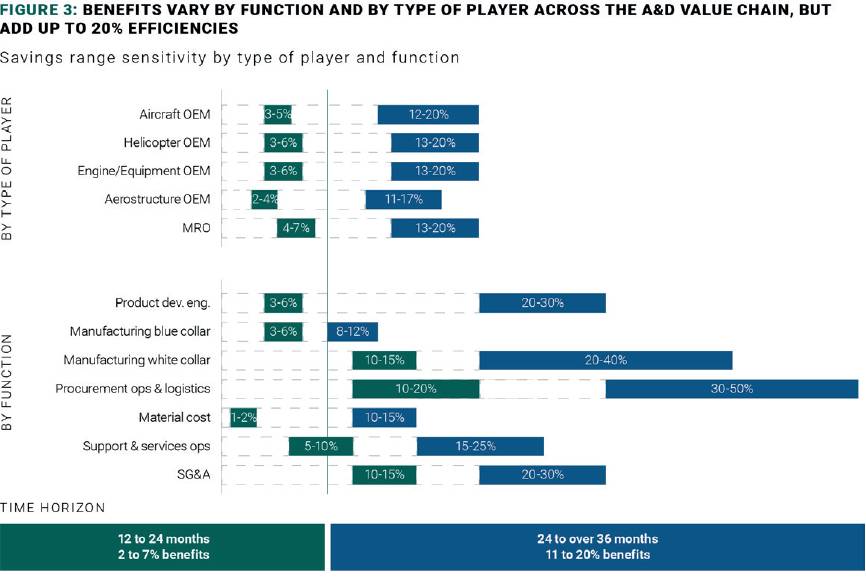

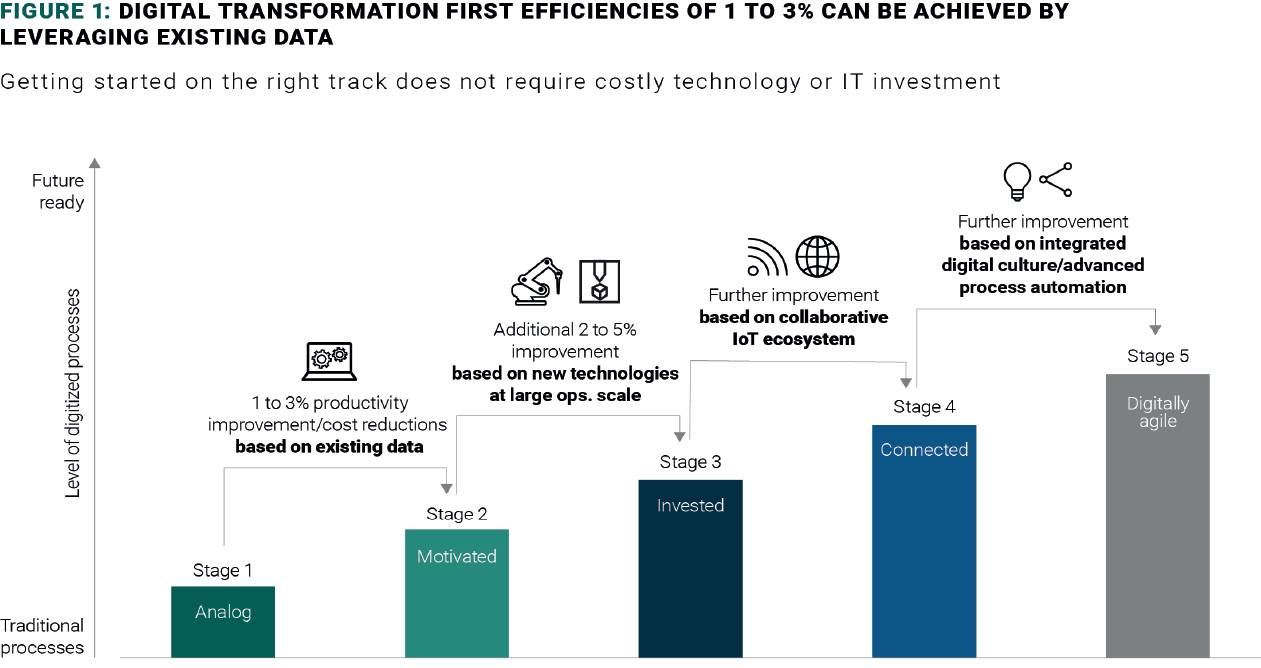

Financial constraints alone are not to blame for the lack of action. True, digital transformation in its most advanced stages requires significant investment in new technology. Until companies reach those later stages, technology investments are not the most crucial aspect of their transformations. The key ingredients of early-stage transformations are the data a company already has on hand and the skills and capabilities of its people. When the right data flows to the right people at the right time, companies can transform themselves with only modest investment. Better yet, most companies can realise efficiencies and improve operations simply by pulling, combining and operationalising the data they already have on hand.

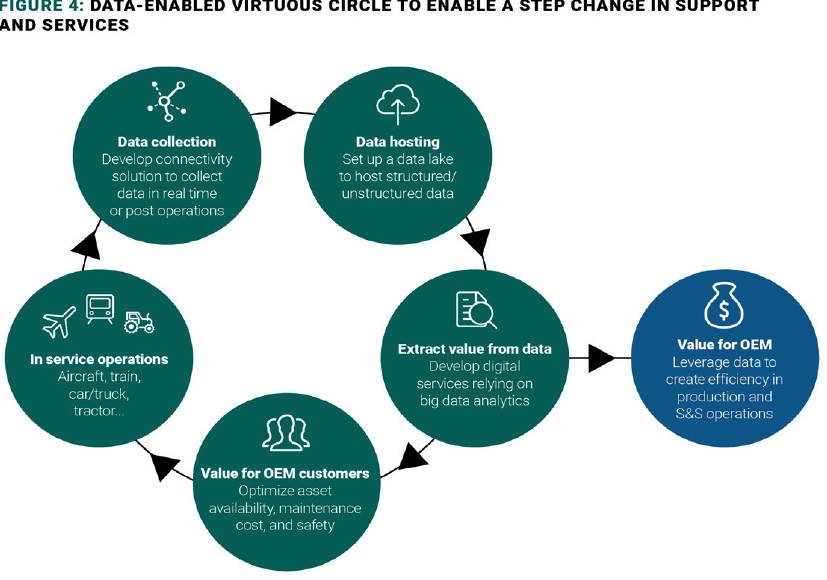

Consider how one global A&D OEM is implementing a digital transformation to improve operational efficiency and to create new revenue streams. The transformation program is focused mainly on operations and its chief short-term ambition is to implement new concepts and technologies that make fuller use of the company’s existing data. Among the most promising areas the company is exploring are connected aircraft, end-to-end digital continuity, adoption of full 3D modelling for every program, digitally enabled design-to-cost, nonconformance reduction, and industrial planning and demand management.

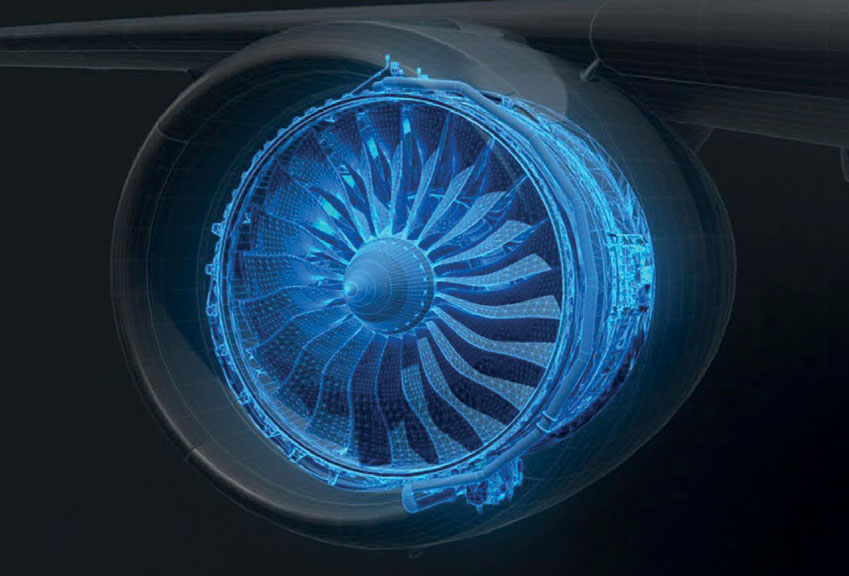

Rolls-Royce launched

its R2 Data Labs to help

power its Intelligent Engine

vision. Rolls-RoyceThe company’s transformation has advanced to the point where digital is at the core of operations. The next steps of the digital transformation entail building an open, collaborative ecosystem that leverages the capabilities of the industrial internet of things (IIOT) and embraces OEMs, Tier1 suppliers, maintenance and repair organisations (MROs), start-ups, tech companies and airlines.

Rolls-Royce launched

its R2 Data Labs to help

power its Intelligent Engine

vision. Rolls-RoyceThe company’s transformation has advanced to the point where digital is at the core of operations. The next steps of the digital transformation entail building an open, collaborative ecosystem that leverages the capabilities of the industrial internet of things (IIOT) and embraces OEMs, Tier1 suppliers, maintenance and repair organisations (MROs), start-ups, tech companies and airlines.

The transformation is already yielding incremental revenues, which the OEM is reinvesting in the transformation. Ultimately, the company expects to invest up to 1% of annual revenue over a period of several years to finance new IIOT technologies and achieve deep changes in the organisation underpinned by M&A and the acquisition of top digital talent.

That company, like others well advanced along the digital path have climbed what might be called the ladder of digital transformation, journeying in stages from ‘analog’ to ‘digitally agile’ (Figure 1). It is not necessary to reach the final stage of maturity to generate EBIT and cash-flow improvements.

Like the OEM cited above, other companies can begin to reap the benefits of transformation once they put in place a long-term plan that features specific initiatives and execute it with the full support and visible commitment of the C-suite. At the company discussed above, the CEO signalled leadership’s commitment to digital by installing a top-level monthly governance process to track and manage digital initiatives. Some will not bear fruit for some time but others can realise low-hanging value within six to nine months or even less, and the value generated can be reinvested in new digital initiatives.