AEROSPACE The economics of electric aircraft – part 1

Plugging into the electric aircraft revolution

Recent months have seen a renewed interest in accelerating the development of passenger aircraft powered by electric or hybrid-electric power. But will these aircraft make money in commercial operation? BILL READ FRAeS looks at the financial challenges faced by electric aircraft designers.

The zero-emissions passenger aircraft is coming. In the not too distant future, we are told, fleets of quiet, non-polluting, super-efficient battery or even hydrogen-powered powered aircraft will replace noisy CO2 2 and NOx x -emitting jets, continuing the role of aviation in connecting people across the world but without the risk of adding to global warming. While much has been written about the different futuristic designs proposed by developers of e-aircraft, less has been said about how these new aircraft will cope with the competitive realities of commercial air transport. Part 1 of this two-part report into the economics of electric aircraft will look first at the challenges of selling commercial electric aircraft to operators and the implications for airport operators and service providers.

WILL IT BE EASY TO INCORPORATE INTO EXISTING AIRPORT INFRASTRUCTURE AND GROUND-HANDLING EQUIPMENT?

Recent months have seen a renewed interest in accelerating the development of passenger aircraft driven by electric or hybrid-electric power. The French government has announced plans to debut a carbon-neutral aircraft by 2035 while British Prime Minister, Boris Johnson vowed that the UK would be the first to develop a zero-emission long-haul passenger aircraft. However, while remarkable progress has been made in recent years on the development of smaller electrically-powered aircraft and eVTOLs, the advent of larger e-aircraft for commercial passenger transport still has a long way to go. Many technical hurdles still need to be overcome, in particular those relating to the power and duration of batteries. Battery technology still has much to do before it can compete with jet fuel as a source of energy. There has also been talk of the potential of hydrogen to power larger aircraft but this technology also faces challenges in developing a hydrogen fuel cell which is small, light and safe enough to be fitted on board an aircraft.

While-e-aircraft have the advantage that they are less polluting and cleaner, they also utilise a less efficient power source than flying an aircraft using kerosene, as charging batteries is less efficient than using the fuel directly. An all-electric aircraft will also weigh the same at the end of a flight as it did at the beginning – unlike a conventional jet aircraft, which gets lighter as it uses up fuel.

A RADICAL NEW AIRFRAME DESIGN MIGHT LOOK FUTURISTIC AND EYE-CATCHING BUT HOW PRACTICAL WILL IT BE IN DAY-TO-DAY AIRLINE OPERATIONS?

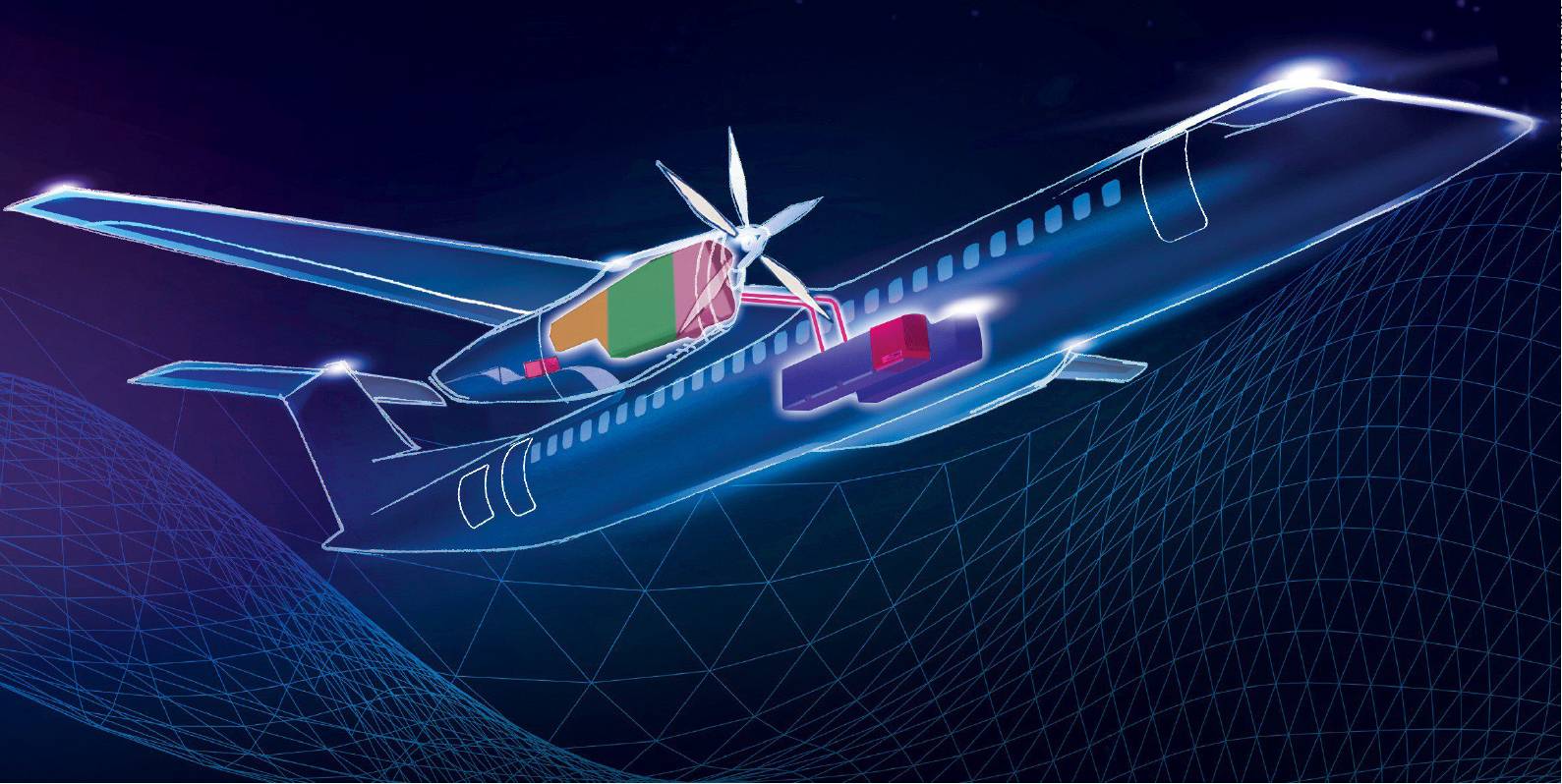

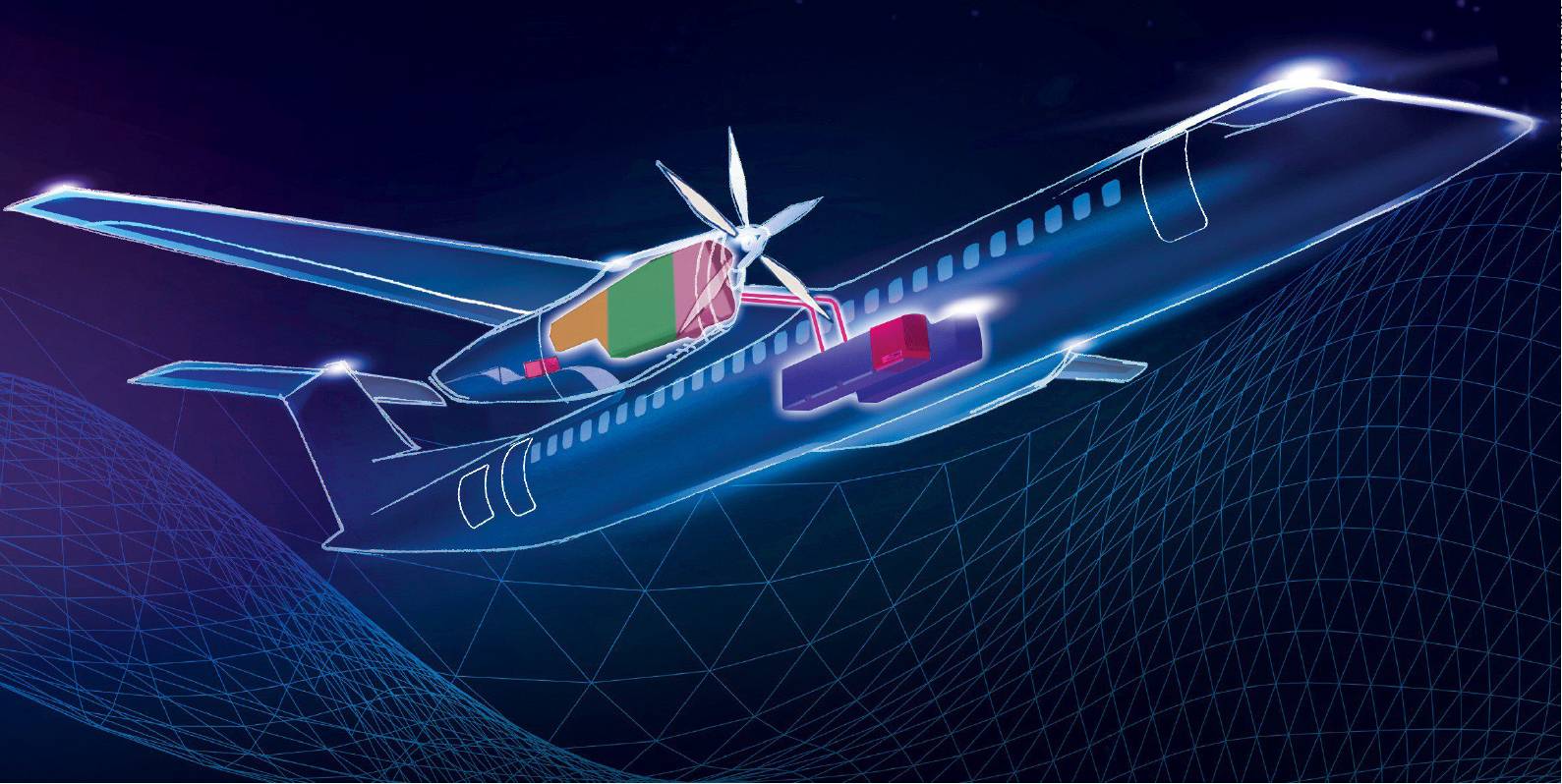

Because the reliability of batteries is not yet assured, current thinking is that, in order to satisfy flight safety regulations, the first generation of electric aircraft is likely to be a ‘hybrid-electric’ design fitted with a supplemental fossil fuel engine to act as an emergency back-up generator, recharging the electric batteries to extend range. However, such hybrid aircraft, although they may be safer, will not be as efficient to operate as either all-jet or all electric-motor aircraft. The back-up motor will take up payload space and add weight, while the aircraft will need to carry both batteries and liquid fuels, which will need to be refuelled and recharged between flights.

As batteries become more efficient, future all-electric designs may have different shapes but, in the interim, e-aircraft might look similar to current regional turboprop designs with long straight wings fitted with either two or multiple propellers.

Short-haul replacement

Even with the hoped-for advances in battery and electric engine technology, experts believe that battery-powered aircraft will not be able to replace all jet-powered aircraft. Although e-aircraft are expected to be quieter, non-polluting and cheaper to operate than jet aircraft, they will fly more slowly and will not have sufficient battery life to stay in the air for long distances. Unless new technology is developed to reduce these restrictions, industry experts are currently predicting that electric aircraft will only replace commercial jet aircraft on short-haul regional routes. As a result, a two-tier system may evolve with e-aircraft operating on short-haul and regional routes while jet turbine aircraft (using more efficient environmentally-friendly engines and sustainable fuels) continue to fly on long-distance routes.

Even with the hoped-for advances in battery and electric engine technology, experts believe that battery-powered aircraft will not be able to replace all jet-powered aircraft. Although e-aircraft are expected to be quieter, non-polluting and cheaper to operate than jet aircraft, they will fly more slowly and will not have sufficient battery life to stay in the air for long distances. Unless new technology is developed to reduce these restrictions, industry experts are currently predicting that electric aircraft will only replace commercial jet aircraft on short-haul regional routes. As a result, a two-tier system may evolve with e-aircraft operating on short-haul and regional routes while jet turbine aircraft (using more efficient environmentally-friendly engines and sustainable fuels) continue to fly on long-distance routes.

The electric aircraft start-up Wright Electric has started to develop the electric propulsion system for a 186-seat electric aircraft called Wright 1. Wright Electric

The electric aircraft start-up Wright Electric has started to develop the electric propulsion system for a 186-seat electric aircraft called Wright 1. Wright Electric

Developing an e-aircraft

As with electric cars, the development of the electric aircraft is expected to progress in stages. In the electric aircraft market, the current buzzword is urban air mobility (UAM); many companies are busy working on new designs for small eVTOLs designed to carry small numbers of passengers on short routes. This pioneering work is helping to accelerate technology and systems which can be used for the development of larger electric aircraft similar in capacity to regional turboprops and jets.

While there are a number of companies currently working on larger e-aircraft designs, it is not the aim of this article to look at specific projects or technical challenges. Instead, the focus will be on the wider operational and economic aspects of operating such a new type of aircraft.

Imagine that you are a start-up company developing a new electric passenger-carrying aircraft. How can you bring your design to market and compete for orders against other manufacturers?

The first obstacle is finance. Even before the onset of Covid-19, developers of electric aircraft were having difficulties staying in business, as it was taking so long to bring a design to the point where it could actually start earning money. This process has since accelerated as developing a new electric aircraft design requires a substantial quantity of investment. As with all innovative projects, there is an element of risk in that development may encounter unforeseen costs, time delays, safety issues or lack of demand. Because so much about the future of e-aircraft is still uncertain, banks and investors tend to be reluctant to risk money in unproven technology and markets. An e-aircraft developer will therefore need to have deep pockets and a strong commitment to investing over the long term.

Traditionally, new aviation technologies have been developed by OEMs and engine manufacturers, often with support from national governments. However, in the case of e-aircraft, more stakeholders will also be involved in creating the infrastructure needed to operate such new aircraft – including airports, pilot trainers, air traffic managers, components suppliers and MRO providers.

Existing aviation regulations are based on conventional liquid-fuelled aircraft. The introduction of hybrid and electric aircraft may require new regulations regarding safety, flight certification, training and maintenance, all of which could take time to evolve.

Rendering of the Project 804 X plane being developed by Raytheon Technologies. Raytheon Technologies

Rendering of the Project 804 X plane being developed by Raytheon Technologies. Raytheon Technologies

Engines, airframes and batteries

The next problem is that of design. What will the new aircraft look like? A radical new airframe design might look futuristic and eye-catching but how practical will it be in day-to-day airline operations? Will it be easy to incorporate into existing airport infrastructure and ground-handling equipment? How easy and economic will it be to service and maintain?

HOW CAN YOU ENSURE THAT THE AIRCRAFT BATTERIES ARE SAFE?

There is also the issue of engines. Will the engines be purchased separately from the airframe (as they often are with current jet-powered airliners or will they have to be developed as an integrated unit by the aircraft manufacturer? The same challenge applies to the incorporation of batteries.

Then there is standardisation. While it is tempting for e-aircraft designers to produce all their own designs which are different from those of their competitors, there is a commercial and practical need to standardise some components, such as battery sizes and charging plugs, so that they are easy to use and replace.

Flight safety certification

Another problem is that of safety. Competent authorities will only grant flight certification to a new electric aircraft if they are convinced that it is safe to carry passengers. How will your new aircraft cope with the rigours and hazards of flight, such as high winds, turbulence, ice, rain, high and low temperatures, lightning strikes or bird and drone strikes? How can you ensure that the aircraft batteries are safe? High-performance batteries need cooling and must be ensured against the risk of fire (as shown by the problems faced by Boeing with battery fires after the introduction of the first 787s and the fire of the first prototype of the Eviation Alice electric aircraft),

In addition, there are operational issues to be resolved. Will your passenger-carrying e-aircraft have two pilots or one, or perhaps be flown autonomously? How will this decision affect the attitudes of safety authorities and pilot unions, as well as passenger confidence?

Airbus and Rolls-Royce made the joint decision to bring the hybrid-electric propulsion E-Fan X demonstrator to an end in April 2020. Airbus

Airbus and Rolls-Royce made the joint decision to bring the hybrid-electric propulsion E-Fan X demonstrator to an end in April 2020. Airbus

Sustained volume production

Assuming that your e-aircraft design is certificated, the next problem is production. Should serial production be attempted by the same start-up company that designed the aircraft or should the responsibility of volume production be handed over to a larger OEM with experience in this area? Alternatively, the OEMs may decide to play catchup by buying up the start-up company.

Decisions will also need to be made about spare parts and aftermarket support. Aircraft OEMs and engine manufacturers make as much, if not more, money from support services than from original equipment sales. As an e-aircraft designer, would you want to try to cash in on this market, or would it be less effort to hand this responsibility over to a third party?

Airports

In a future where there are now e-aircraft designs ready to fly, the next question is who will buy them and how will they be operated? But first, it could be instructive to look at the airport infrastructure and support services in which electric aircraft will operate. As with much new technology, there is the question of who jumps first. Airlines will not acquire e-aircraft if there are no airports they can operate from. Similarly, airports will not commit to building electric aircraft infrastructure until they are sure that such aircraft will be introduced in sufficient numbers to justify the investment in new facilities (a dilemma faced by several airports when the Airbus A380 was first introduced).

Imagine that you are an airport operator deciding how best to invest for the future. You know that electric passenger aircraft will be coming in the future, so how best can you attract airlines operating e-aircraft to base at your airport or to use your facilities?

IN A FUTURE WHERE THERE ARE NOW E-AIRCRAFT DESIGNS READY TO FLY, THE NEXT QUESTION IS WHO WILL BUY THEM AND HOW WILL THEY BE OPERATED?

There would certainly be advantages. Operating electric aircraft would greatly reduce the airport’s carbon footprint. Electric aircraft would be both non-polluting and quieter, meaning that airports close to populated areas could operate for longer hours or overnight without disturbing local residents. It would also do wonders for the airport’s environmental image. In October 2018, Heathrow Airport announced that the first electric-hybrid aircraft to use its facilities will not have to pay Heathrow’s landing charges for an entire year if it was operated in a regular service hub – an offer valued at nearly £1m.

There would also be disadvantages. Current jet-powered passenger aircraft all share a common ‘tube and wing’ shape which may vary in size but which can be loaded or unloaded using existing airport equipment. Airport ground-handling services are geared up to working with conventional designs. “Introducing electric aircraft would involve new interfaces between airport and aircraft and ground-handling systems,” concluded Jean-Brice Dumont, EVP engineering at Airbus, speaking at the 2020 Singapore SATLF conference.

However, the advent of passenger-carrying electric aircraft with new shapes and characteristics would require the learning of new skills. Ground-handling infrastructure may have to be created to manage e-aircraft with unconventional shapes, such as long thin wings requiring more space between parked and moving aircraft.

Compatibility

Compatibility

Airports may also have to cater for two different types of electric aircraft needing to be refuelled or recharged. Pure electric aircraft would require battery changes while hybrid-electric aircraft will have two sets of engines, one needing fuel and the other batteries. Airport ground-handling staff would have to become familiar with the workings of a wide variety of different e-aircraft designs and have all the different types of batteries and associated equipment on hand needed to service them. The batteries may be stored in different places on the aircraft, possibly in the wings or within the fuselage. Some e-aircraft may be recharged with the batteries in situ, while others will have their used batteries swapped out for a new fully-charged set. The size and shape of batteries may also vary between each aircraft design, as might the connectors needed to recharge them (a problem experienced in miniature by every owner of a mobile phone).

Air traffic managers would also have to learn new methods of operation, co-ordinating the movements of fast jet airliners with slower e-aircraft. There are also operational safety issues as to the potential restrictions on e-aircraft operations of adverse weather or how airport fire crews and emergency services should react to a take-off or landing accident or a battery fire on the ground.

Regional airport market

One prediction for the future of electric aircraft is that they could be operated from smaller airports which previously could not cope with the economics of commercial flights – thus generating a totally new market. However, this would only be possible if these airports have the necessary infrastructure to cater for e-aircraft – such as battery chargers, ground crew to change or recharge batteries and MRO service providers with the relevant technical knowledge and access to spare parts. If e-aircraft did generate a demand for the more intensive use of regional airports, these airports would also need to invest in new passenger and transport infrastructure, such as new terminals, roads and parking.

Eviation’s Alice, a light nine-seater all-electric plane designed to service regional areas. Eviation

Eviation’s Alice, a light nine-seater all-electric plane designed to service regional areas. Eviation

MRO

Turning to the question of support services, imagine that you are an MRO provider keen to profit from the growing market for servicing electric aircraft.

It is predicted that servicing costs for e-aircraft will be lower, at least for engines, as electric motors are less complicated than jet turbines and should require less maintenance. Airframes, on the other hand, may have higher maintenance costs depending on how they are constructed, such as is already being experienced with the increased use of composite structures where damage is more difficult to detect and repair. Standardisation of components and the availability of spares would also have an effect on costs and time scales.

WILL YOUR PASSENGER-CARRYING E-AIRCRAFT HAVE TWO PILOTS OR ONE, OR PERHAPS BE FLOWN AUTONOMOUSLY?

MRO providers will also have to adapt to new norms as e-aircraft are expected to have a different operating cost structure than jet aircraft. An all-electric aircraft will not require a fuel system but would require the regular replacement of batteries. However, what is not yet known is how the experience of using electric aircraft in regular commercial operations may throw up new maintenance issues not yet thought of, as batteries and motors are exposed to heat, cold, sunlight, ice, turbulence and all the other rigours of flight.

Many MRO providers, engine manufacturers and OEMs are taking full advantage of digital systems to record multiple parameters of aircraft in flight, predictive maintenance, flight testing and digital twins. Once the designs for electric aircraft and motors have become clearer, MRO providers can start working on the most efficient ways to maintain them – most likely with the assistance of digital modelling, robotic inspection systems and digital printing already being used on existing airframes.

RAeS Urban Air Mobility, Virtual Conference; 30 September 2020 – 1 October 2020

Part 2 of this report into the economics of electric aircraft will consider how airlines could be persuaded that there is money to be made in game-changing new e-aircraft designs and how will they might be operated in commercial service.