For the next 45 years Qantas remained uniquely an international airline without a domestic network. While this had its challenges from a business perspective, it necessitated a global outlook and a focus on growing foreign markets.

By the 1970s, Qantas had become an Australian icon by being synonymous with both pioneering and with aspects of the national interest overcoming isolation, developing technological independence and putting in place the air transport infrastructure necessary for trade, business, immigration, family reunion, tourism and cultural exchange with key foreign markets. It also provided airlift capacity for defence and in national emergencies.

Privatisation

By the mid-1980s, Qantas was the most visible overseas manifestation of Australia. However, government ownership support was no longer a political priority. Qantas was starved of equity with $11.50 of debt for each dollar of equity. This had to be addressed.

John Ward, former Qantas CEO.

John Ward, former Qantas CEO.

The resulting privatisation which followed the acquisition of the purely domestic Australian Airlines in 1992 required a commercially sustainable balance sheet and the attainment of globally competitive operating and financial metrics.

Privatisation also meant that, unlike the situation with many of its foreign competitors, it was largely the appetite of the capital markets that would henceforth be the ultimate determinate of the size and shape of Qantas.

Realised merger synergies resulted in a substantially lower post-merger domestic cost base and its potential for high-profit generation. Qantas’ initial post-privatisation focus was therefore on maximising the returns from its domestic network while strengthening its international competitiveness through co-ordination with its domestic network.

Intrinsic to Qantas’ historical success has always been taking a long-term perspective with careful and early investment in new technology to secure competitive advantage in both product and operating costs. This remains true and is now augmented by the need for capital market support, requiring healthy cash generation and a continuing investment-grade credit rating.

From left to right: early Qantas Empire service; John Travolta takes part in celebration of Qantas’ past in 2014’s use of retro livery, pre-war Qantas advertising poster.

From left to right: early Qantas Empire service; John Travolta takes part in celebration of Qantas’ past in 2014’s use of retro livery, pre-war Qantas advertising poster.

Leadership

No retrospective on Qantas would be complete without some commentary on leadership.

At Qantas, leadership has always been the art of listening to a broad range of stakeholders while determining what is best for the long-term future of the company and then gaining the support of key constituencies by providing them with the knowledge base to embrace the company’s conclusions and accept its strategies.

While shareholders’ interests were never subordinated to those of other groups, it was always accepted that stakeholder considerations were part of a strategy to promote company sustainability and maximise value over the longer term. Indeed, this embodiment of what are now known as environmental, social and governance (ESG) principles has been a feature of leadership at Qantas throughout its 100-year history.

Six Qantas CEOs – from left Alan Joyce, Geoff Dixon, the late James Strong, John Ward, John Menadue and the late Ron Yate.

Six Qantas CEOs – from left Alan Joyce, Geoff Dixon, the late James Strong, John Ward, John Menadue and the late Ron Yate.

During this time, when making strategic decisions, Qantas has often needed to balance a range of often complex and competing stakeholder interests in concluding what actions are in the best interests of the company. At various times these different stakeholder interests have been accorded different weightings. Profitably serving the national interest was a key criteria under government ownership while delivering a competitive return has become key post-privatisation.

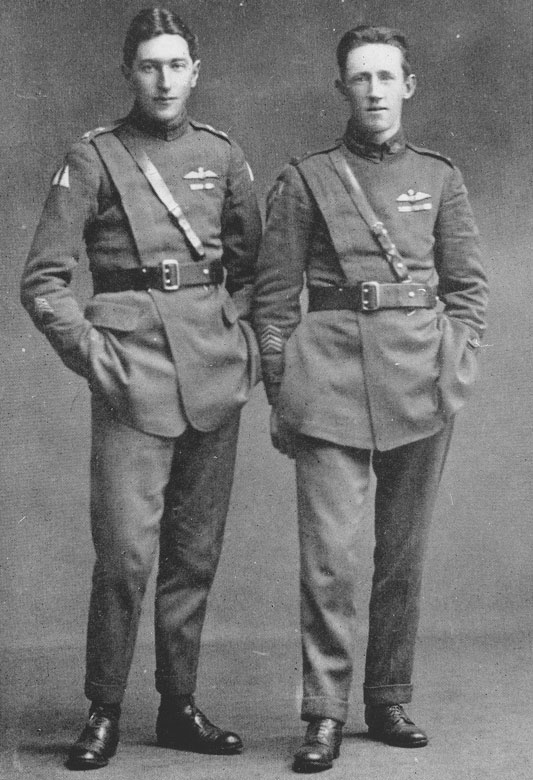

Qantas founders, Paul McGinness and Hudson Fysh

Qantas founders, Paul McGinness and Hudson Fysh