AIR TRANSPORT Air India strategy

Return of the native

NEELAM MATHEWS looks at the journey made by India’s national carrier, Air India, from state ownership back to the Tata Group, its original owners.

Tata Air

Tata Air

After decades of turning back on decisions to privatise Air India, the present government has put its money where its mouth is. National carrier Air India has been sold for $2.7bn to Tata Sons, the main investment holding company and promoter of Tata companies under its subsidiary Talace Pvt formed to submit the bid for the acquisition.

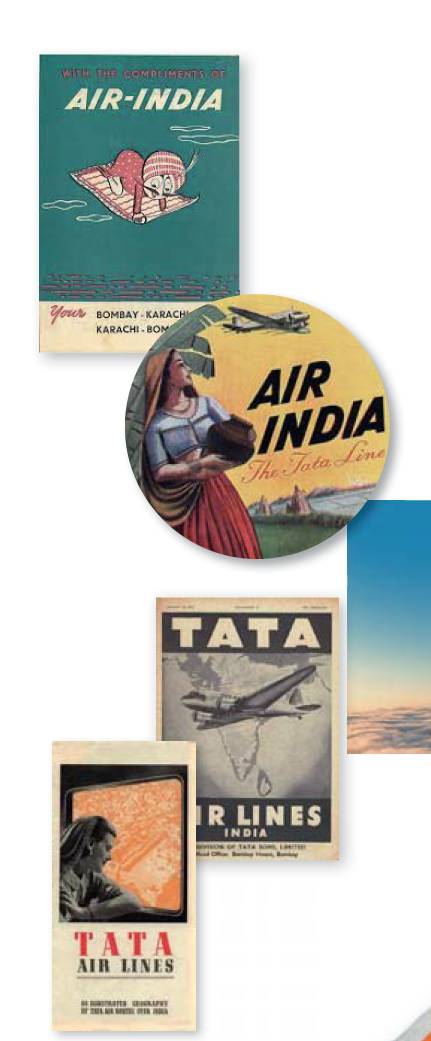

Air India/TATA airlines through the ages. Tata Air/Tata Air/Air India

Air India/TATA airlines through the ages. Tata Air/Tata Air/Air India

Life has come full circle for the Tatas.

JRD Tata, who guided the destiny of the group for over half a century, launched Tata Airlines in 1932 which was then nationalised in 1953, but on 27 January this year, the $315bn group got full ownership of Air India and its profitable subsidiary, Air India Express, that flies primarily to the Middle East and South East Asia.

It also took over Air India’s 50% share of the joint venture with Singapore Airport Terminal Services (SATS) that provides ground handling services across airports in India. Tata Group also owns 51% of Vistara with 49% held by full-service Singapore Airlines and budget AirAsia India.

The Maharaja brand on whom memorable advertisements have revolved around for decades, is now back with the Tatas. It is unlikely to be changed for the moment as it requires a vast deal of paperwork and must adhere to ICAO display guidelines. However, as one pilot mused: “The Maharajah needs to be modernised.

Like Air India, he has too much fat on him. He needs to be a six pack with a contemporary lean, clean image”.

The euphoria at Tata Sons is understandable as past attempts to acquire the airline, along with SIA, were caught in political indecision.

Former Tata Sons Chairman Ratan Tata, reacting on the win, admitted it would “take considerable effort to rebuild Air India.”

He added: “Air India, under the leadership of JRD Tata, had, at one time, gained the reputation of being one of the most prestigious airlines in the world. Tatas will have the opportunity of regaining the image and reputation……Welcome back, Air India!”

However, times have changed and the Tatas are faced with the formidable task of giving a semblance of a new look to the ageing carrier that has inherited an excess baggage of dated mindsets and a large unmotivated workforce with an aversion to perfection and excellence.

As Indian aviation propels itself upwards post the debilitating Covid era, a restructured airline with tightened operating costs could help Air India rise from the ashes given that, pre-privatisation, it was losing around $150m a day.

Servicing Air India airliners. Neelam Mathews

Servicing Air India airliners. Neelam Mathews

Strict adherence and an inherent discipline – a hallmark of the Tata Group is starting to become visible. “Smoking and consumption of intoxicating substances at the workplace are banned,” according to the airline’s Chief Human Resources Officer, Suresh Dutt Tripathi.

Any employee violating this order will be “dealt with appropriate consequences,” he said. This dictate indicates non-adherence to the pre-Tata reign.

On the disciplinary trail, around 1,800 Air India staff – once under the umbrella of labour unions – have been asked to vacate the company-provided accommodation by July. Air India has warned failure to do so will result in penalties and loss of retirement benefits.

The going will not be easy. Efforts are on to synergise Tata’s four airlines and AI-SATS under one roof in Gurgaon, on the outskirts of Delhi, to optimise operations.

With Tata’s signature in every major industry, there is hardly a product inside the cabin, for instance, that does not have a Tata connection – from the coffee grown on Tata estates, Starbucks franchises, supplies from its online grocery, to the wi-fi when introduced!

Flying on its airlines, and buying its products, including more than 100 hotels, earns customers rewards under its recently launched TataNeu programme. Vistara and AirAsia India are presently integrating rewards for flights on TataNeu.

There are critics that say just having a Tata name will not tide over fundamental inadequacies. “When you have an airline you took over four months ago and knew months before that you had won the bid, and still do not have a management team fully in place, then you do not exude confidence,” a senior airline official told AEROSPACE. He did acknowledge: “These are early days yet” and Tata does seem to have a plan. With senior management people set to retire in August, it has started training its own people. “They expect a smooth exit and Tata has been known to have its own bureaucracy and way of functioning, leaning on its own people to take up senior jobs.”

According to Vishok Mansingh, Director Vman Aero: “This is a period of house warming [and] they will settle with the team that will take over...The big change will be in October when the winter schedule starts.” Consolidation in routes, focus on finances and cashflow and clearing of outstanding issues are in progress but the company, at present, has taken a pledge of silence and media queries remain unanswered.

Even learnings for the Tata Group are not sacrosanct. In February, the appointment of former Turkish Airlines chairman IIker Ayci as the new MD and CEO of Air India came as a surprise. Having overlooked the strained geopolitical relations between Turkey and India, the decision lacked the Tata panache. N Chandrasekaran, Chairman of Tata Sons, had kind words for Ayci saying: “He will lead Air India into the new era.” However, within two weeks of the appointment, Ayci had resigned even before international media referred to his al-Qaeda links. AEROSPACE could not confirm this.

In mid-May, Tata Sons, keeping in-house skills in the family, appointed Campbell Wilson, former CEO of SIA subsidiary budget Scoot as CEO and MD of Air India. He brings with him 26 years of aviation industry expertise across both full service and low-cost airlines. In a farewell note to his employees, Campbell called the move a “fantastic opportunity ……[with] “mountains to climb.” The Center for Aviation Consultancy has said one of the main challenges will be aligning all of the dis parate airlines, “and in some cases it is likely consolidation will take place.”

Tail fin of an Air India Boeing 787-8. Alan Wilson

Tail fin of an Air India Boeing 787-8. Alan Wilson

Indian carriers are in a combative mode as domestic and international travel increases. Domestic air travel in April touched 10.5m passengers, only 5% lower than pre-pandemic levels.

Akasa Air with 72 Boeing 737 Max aircraft on order and Jet Airways – now under a new ownership – are set to resume operations this year. However, India continues to be a fragmented market with the largest share of around 56% held by budget carrier IndiGo, which has more aircraft than all others combined.

Presently, Air India is sprucing up its image with an improved meal service, hygiene and an on-time performance. “While operationally nothing much has changed as yet, meal services have undergone an improvement.... Just changing meals will not suffice, but it’s a start,” said an official. Full service is now back in the business class cabin with crockery, cutlery, etc.

“Tatas are in the business of running luxury hotels so this follows.”

Restructuring is a mammoth task as the carrier has a mix of budget, full service and hybrid airlines. This is a task expected to continue for around five years before it returns to profitability. The first on the list is AirAsia India.

Restructuring is a mammoth task as the carrier has a mix of budget, full service and hybrid airlines. This is a task expected to continue for around five years before it returns to profitability. The first on the list is AirAsia India.

The merger of Vistara is still a few years away, given the nature of the contract and the commitments of the joint venture. There has also been speculation on Singapore Airlines’ continued interest in Vistara. At a post-result conference call in late May, SIA’s CEO Goh Choon Phong was gung-ho. “We will continue to support Vistara’s growth,” he said. Vistara has a fleet of 51 to be upped to 70 by 2023.

Upgrading the neglected fleet is the first priority and for that Tata has recently appointed MRO veteran Arun Kashyap from SpiceJet. The maintenance arm of the airline is now no longer part of the Tata Group – Air India Engineering Services Ltd (AIESL) has skilled people but is sparsely marketed. It is certified for 12 and 16 yearly checks (D checks) – and will soon be privatised.

Word has it that Tata could look at buying AIESL. However, there is discontent among the technicians, who are demanding salary revision and full-time employment rules, that has affected smooth functioning of flights. “We are lost. We do not know which company we belong to as the government still seems to have some sway over Air India,” said an irate technician.

Campbell Wilson, CEO, Scoot Air (Scoot Air)

Campbell Wilson, CEO, Scoot Air (Scoot Air)

Shabby seats have been a hallmark of Air India’s fleet of 115 aircraft. Of those, 37 are currently parked due to incomplete maintenance and lack of demand during the pandemic. While 27 Airbus A320neo airframes do not need upgrades, a request for proposal (RfP) has been issued to private third-party providers for 15 short/mediumhaul A321s.

Five A320s have been transferred to the Defence Research Development Organisation and nine are being converted with high-density seating (210-220 seats) to target the domestic and Middle East market, AEROSPACE has learnt. Efforts are ongoing to get a commonality in the mix of Recaro and Safran seats on the A320s as higher volumes will help negotiate better rates with the OEM.

RfPs have also been released for C checks for the A320s. The airline’s Boeing 777s and 27 Boeing 787-800s are also to be upgraded. With international travel surging to around 1.85m passengers in April 2022, an engineer said these long-haul aircraft should have been on the top of the list if Air India wants to make a swift beeline to the global market.

The regulator, Directorate General of Civil Aviation (DGCA), has made it less easy and the privatised Air India will no longer get preferential treatment under bilateral agreements. IndiGo, meanwhile, has announced major international expansion plans from mid-2024, as has Akasa Air.

Six Airbus 350-900s have been ordered to replace two of the existing three B777-200s and 4 of 15 B 777- 300 ERs, AEROSPACE has learned. Global sanctions mean three A-350-900s, destined for Aeroflot, have moved into storage and Finnair and Q atar A350s are also on hold. Could the buyer be Air India? “Tatas are a tough, pushy and demanding customer and I would not be surprised if the aircraft will head to India,” said an official.

AirIndia One – the VVIP 777-300ER modified by US GDC Technics for the Prime Minister – was an Air India airframe. At present two of the same models transferred by Air India to AIESL are being modified at the Nagpur facility by GDC. “The Air In dia One by default, gives Tatas an upmarket image,” said a marketing expert. Sadly, the DGCA deregistered Air India’s last four Boeing 747s, said to be in a neglected shape, and which Tata had refused to take on given the high cost of repairs.

Tatas’ strength lies in its workforce, comprising thousands of skilled designers, engineers and programme managers, making it the best in the business. So, when Air India’s SITA passenger service system (responsible for storing and processing personal information of passengers) was compromised and subjected to a cyber-security attack last year, affecting around 4.5m, Tata was not going to take it lying down. It has migrated its back-office operations to Amadeus. “For Star Alliance, the switch by Air India to Amadeus has its benefits with major Star members on the Amadeus passenger service systems.

Air India Boeing 787- 8 Dreamliner.. Dean Morley

Air India Boeing 787- 8 Dreamliner.. Dean Morley

It would ease the integration of services between our members. It would (also) improve time to market in the implementation of our customer experience standards across the alliance,” Jeffrey Goh CEO Star Alliance told AEROSPACE. Lack of integration with Star members’ systems has been a longstanding issue in the past. “We have a long history of digitalisation and innovation. With new owners at Air India, we look forward to investments in products and services, designed to enhance customer experience. …...To that end, we will be working to support Air India in leveraging digital and technological opportunities within the alliance,” he added.

Amadeus broad-based products address budget and full-service airline requirements and the commonality will prove useful to Air India and Vistara once fully restructured. Navitaire, a wholly-owned subsidiary of Amadeus, is used by AirAsia India. Meanwhile, in Tata’s footsteps, Vistara has become the first airline in India to have RFID on life vests.

Air India joined Star Alliance in 2014. “India is an important market for the alliance and Air India a very valuable member......,” said Goh. Lufthansa is also extending its arms in association. “Both Air India and Vistara have been long-term partners of our group and we hope to intensify our partnerships throughout India in the future,” Elise Becker, Vice President of Asia-Pacific Lufthansa Group Airlines, said recently.

Alliances are far from dated and add value said Goh. “They offer a unique customer experience proposition in the intersections of a multi-airline itinerary,” explained Goh. “Alliances also offer a unique loyalty proposition. There is more that we are working on this year, and we are looking forward to offering several industry-first solutions in our 25th anniversary year.” Air India’s Frequent Flyer programme is aligned to Star members.

Alliances are far from dated and add value said Goh. “They offer a unique customer experience proposition in the intersections of a multi-airline itinerary,” explained Goh. “Alliances also offer a unique loyalty proposition. There is more that we are working on this year, and we are looking forward to offering several industry-first solutions in our 25th anniversary year.” Air India’s Frequent Flyer programme is aligned to Star members.

There is an extensive wish list. “One hopes the new owners continue the good work of increasing the percentage of women on its rolls,” said Nivedita Bhasin, a retired captain of the 787. At present 15% of pilots in Indian carriers are women – the highest in the world. She added: “Hopefully they will follow a sustainable trail.” Air India has already tied up with Neste to carry out flights on sustainable aviation fuels.