AIR TRANSPORT Sustainable aviation fuels

Fuelling aviation sustainability

Sustainable aviation fuels will become an increasingly vital part of the effort to limit emissions from aircraft over the coming years. Who is producing what, and how? ALAN DRON investigates.

Shell Aviation

Shell Aviation

Covid-19 may have hogged the civil aviation headlines for the past two years but sustainability and the search for lower emissions never went away.

It is generally agreed that popular sentiment has reached a tipping point and national populations are now fully seized by the need to cut fossil fuel use to minimise the growth of global warming.

The public interest in November’s COP26 conference in Glasgow, together with the increasing frequency of extreme weather events, shows that even seemingly small increases in average global temperatures above pre-industrial era levels can have major effects. These include the melting of the polar ice caps and subsequent rising sea levels, plus both abnormal rainfall and summer temperatures. Parts of the Persian Gulf, for example, are experiencing increasingly common summer temperatures of 50°, close to what is bearable for humans.

Aviation’s answer

Aviation is reckoned to account for around 2.5% of global CO2 2 emissions but the rise in global air transport means this figure is expected to rise to at least 4% in coming years if no mitigating measures are taken.

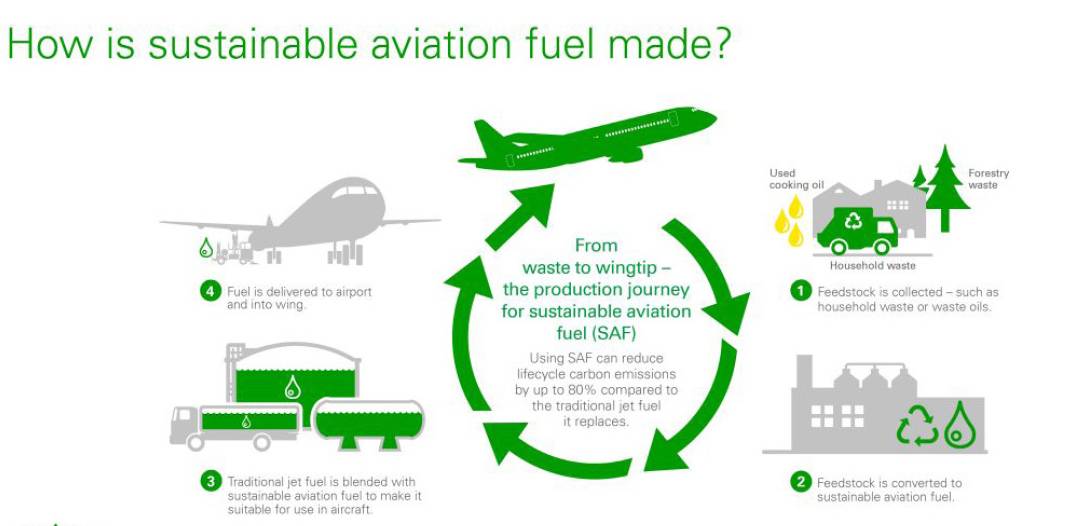

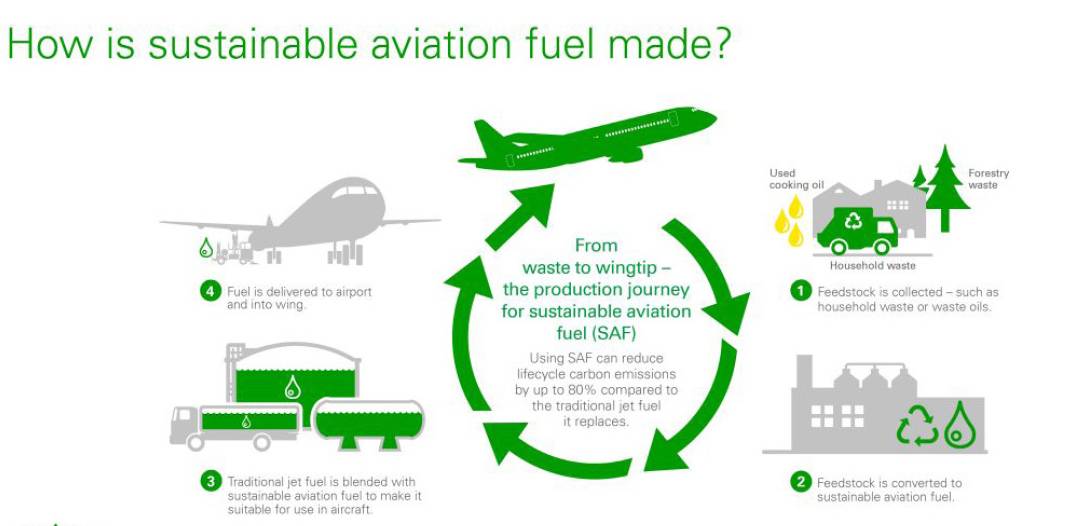

Sustainable aviation fuels (SAF) are regarded as the essential way forward, although SAFs made from feedstocks other than fossil fuels are themselves increasingly regarded as a stopgap measure until alternative power sources, such as hydrogen fuel cells are developed in the mid-to-late 2030s.

There are multiple technical routes to producing SAFs. “To date, there are seven SAF production technologies approved by the American Society for Testing and Materials, which is the organisation that drafts and produces international technical standards, including for aviation fuels,” said Joël Navaron, president, Aviation, TotalEnergies.

“Among these technologies, some have a higher level of industrial maturity, already making it possible to manufacture biofuels that can be incorporated up to 50% into conventional aviation fuel.”

TotalEnergies lists some of the methods as:

- HEFA (hydro processed esters and fatty acids): This is the only method currently at the commercial stage. The raw material comes from materials, such as used cooking oils.

- ATJ (alcohol to jet): This technology could offer flexibility on raw materials, such as industrial gases or lignocellulose (vegetable waste), used to produce ethanol.

- FT (Fisher Tropsch): This production route is based on so-called advanced raw materials, such as agricultural and forestry residues or municipal waste. This path requires very high investments for large-scale commercialisation.

“Among the SAF family, we can also include e-fuels, synthetic fuels produced from hydrogen – ideally from renewable electricity and CO2 2 – which can be extracted from ambient air or industrial effluents. These technologies, for the moment at the R&D stage, remain extremely expensive but could become a particularly promising path in the longer term.”

Producing SAF from waste oils is the method currently used by TotalEnergies, (which is also looking at developing other production pathways, such as hydrogen and e-fuels) and by Finland-based Neste, which started investing in renewable production facilities in 2005, with refineries at Porvoo near Helsinki, Rotterdam and Singapore.

“We’re using various oils and fats to produce hydrocarbons,” said Sami Jauhiainen, vice president business development at Neste’s renewable aviation business unit. “Most of its renewable fuels capacity has, until now been used to produce renewable diesel but further distillation of the material produces jet fuel.”

Sustainable fuel from a shell

Shell, meanwhile, announced in April 2021 that it was investing in US SAF technology and production company LanzaJet. The UK-Dutch fuel producer announced that, together with LanzaJet’s parent company Lanzatech, state-owned Swedish power company Vattenfall and Scandinavian Airlines (SAS), it would “investigate the production of the world’s first synthetic sustainable aviation fuel (SAF) using the LanzaJet’s alcohol to jet technology on a large scale in Sweden.

Shell Aviation

Shell Aviation

“The SAF would be produced using fossil-free electricity to produce hydrogen that, together with recycled carbon dioxide, would then be converted to SAF.”

Shell is also exploring producing SAF from green hydrogen and biomass at its Energy and Chemicals Park Rheinland in Germany, while in the Netherlands it is exploring the opportunity to produce SAF.

In the Netherlands it is investigating converting waste into jet fuel by combining Canadaheadquartered Enerkem’s waste gasification technology and Shell’s Fischer-Tropsch technology. Enerkem’s platform creates ultra-clean ‘syngas’ from waste, while Shell’s technology can upgrade this syngas to SAF.

To meet its ambition of producing 2m tonnes of SAF annually by 2025, “we are investigating several other opportunities in Asia-Pacific, Europe and North America but investments in new production facilities will be the subject of future announcements,” said a Shell spokesman.

Future fuels

Many early attempts to produce SAFs from various feedstock crops fell foul of the fact that they either diverted foodstuffs from human consumption or used valuable arable land and fresh water supplies. To get around these problems, one possible fuel source being examined in Abu Dhabi is mass production of the Salicornia plant, which thrives in salty conditions and thus can use seawater for irrigation. Initial results are promising – the plant’s seeds produce around 30% of their weight in oil – but the project is still in its very early stages.

In the longer term, more exotic technologies are being actively investigated. There has been increased interest in electro-fuels. Also known as power-to-jet, power-to-liquid (PtL) or electro-fuels, these are obtained by using electricity to produce hydrogen through electrolysis, which is then combined with carbon to yield a liquid hydrocarbon that can be consumed in an internal combustion engine. PtL fuels are considered renewable fuels of non-biological origin if electricity from renewable sources is used in the process.

The production process is currently very expensive, with EASA estimating that PtL fuels are three to six times more expensive than kerosene, due to high conversion losses and high transportation and distribution costs. According to a recent European parliament report, the price of PtL fuels is up to €7 per litre, although this is expected to fall to €1 to €3 per litre by 2050, if economies of scale can be achieved and the price of renewable electricity decreases.

Air bp

Air bp

The biggest problem currently facing the aviation industry, however, is simply laying its hands on enough SAF. At November’s Arab Air Carriers Organisation annual meeting in Doha, Qatar Airways Group CEO Akbar Al Baker said his airline would readily buy more SAF if it was available – but it was not.

His comments were echoed by Delta Air Lines’ CEO Ed Bastian last month: “We’re in an industry that’s classified as hard to decarbonise because we don’t have the bio-fuels or the sustainable aviation fuels (SAFs) en masse yet that we’re going to need.”

Many airlines have started to adopt small quantities of ‘drop-in fuels’ – non-fossil fuel-derived substances – that can be added to standard Jet A1 without any technical changes being required to powerplants.

Several airlines have undertaken one-off flights using combinations of significant quantities of SAFs, together with measures, such as constant climb and descent and more efficient ATC routing to achieve significant reductions in CO2 2 emissions.

However, these flights, while welcome statements of intent, do not begin to address the vast quantities of SAFs that will be required to move the needle on the aviation industry’s emissions’ dial.

Scaling up production is under way. Neste, for example, will see renewable fuel production at its three refinery sites jump from 3.2m tonnes to 4.5m by early 2023. Neste’s SAF production, capacity in the meanwhile, will jump from the current 100,000 tonnes to 1.5m tonnes by 2023. TotalEnergies is converting its Grandpuits refinery in France to SAF production, delivering 170,000 tonnes by 2024, the equivalent of 2% of SAF in each flight in France. Shell aims to produce 2m tonnes a year by 2025 and that, by 2030, SAFs will constitute 10% of its global aviation fuel sales.

These, plus other companies across the globe that are seeking to start up SAF production, will undoubtedly help to kick-start mass production but increased quantities will take time to materialise. Even with current expansion plans, huge amounts of further investment will be required to meet even a small part of airlines’ needs.

IATA’s sustainable fuel plan

The International Air Transport Association’s (IATA) AGM in Boston in October approved a resolution for the air transport industry to achieve net zero carbon emissions by 2050. This would align with the Paris Agreement goal for global warming not to exceed 1.5°C.

IATA director-general Willie Walsh admitted that achieving net zero emissions “will be a huge challenge. The aviation industry must progressively reduce its emissions while accommodating the growing demand of a world that is eager to fly”.

A key immediate enabler is the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This will stabilise international emissions at 2019 levels in the short-to-medium term.

“Achieving sustainable global connectivity cannot be accomplished on the backs of airlines alone,” Walsh added. All industry stakeholders, including governments, had to take responsibility to address the environmental impact of their policies, products, and activities.

“We have a plan. The scale of the industry in 2050 will require the mitigation of 1.8 gigatons of carbon. A potential scenario is that 65% of this will be abated through SAFs. We would expect new propulsion technology, such as hydrogen, to take care of another 13%. And efficiency improvements will account for a further 3%. The remainder could be dealt with through carbon capture and storage (11%) and offsets (8%).”

Government policy frameworks focused on realising cost-effective solutions would be essential, he added. “Government policies have set the course and blazed a trail towards success. The costs and investment risks are too high otherwise. The focus must be on reducing carbon. Limiting flying with retrograde and punitive taxes would stifle investment and could limit flying to the wealthy. Incentives are the proven way forward. They solve the problem, create jobs and grow prosperity.”

IATA has proposed a base case scenario to achieve net zero emissions for aviation by 2050 with the following milestones, but insists that other measures, including more efficient air traffic control measures, such as the much-delayed Single European Sky, must play a part.

2025: With appropriate government policy support, SAF production is expected to reach 7.9bn litres (2% of total fuel requirement).

2030: SAF production 23bn litres (5.2% of requirement).

2035: SAF production 91bn litres (17% of requirement). Electric and/or hydrogen aircraft for the regional market (50-100 seats, 30 to 90min flights) become available.

2040: SAF production 229bn litres (39% of requirement). Shorthaul hydrogen aircraft (100-150 seats, 45 to 120min flights) become available.

2045: SAF production 346bn litres (54% of requirement).

2050: SAF production hits 449bn litres (65% of total fuel requirement).

The cost of sustainability

The other major problem facing airlines is the significantly greater cost of SAFs. At present, these are four to five times more expensive than conventional fuels. This is not supportable. The cost differential will start to shrink as the quantity of SAF available increases but SAFs will always be the more expensive option.

For the customer, the cost for a flight fuelled with just a 1% SAF component will be $5 more expensive for a Paris-New York round trip, reckoned Navaron. “Going towards net zero will not be at zero cost.”

Air bp has recently agreed to supply sustainable aviation fuel to three dedicated business aviation airports in the UK; including London Biggin Hill (BQH), Airbus owned Hawarden (CEG) Airport in Flintshire and Centreline FBO, in Bristol (BRS). Air bp

Air bp has recently agreed to supply sustainable aviation fuel to three dedicated business aviation airports in the UK; including London Biggin Hill (BQH), Airbus owned Hawarden (CEG) Airport in Flintshire and Centreline FBO, in Bristol (BRS). Air bp

Andreas Schafer, professor of energy and transport at University College London, told the BBC in November that initial research by his team suggested airfares will need to increase by 10%- 20% to cover the costs.

“In the short term, government support will be needed with those costs as decarbonising aviation will be extremely challenging, and current efforts will need to be scaled up dramatically,” he added.

Meanwhile, several European nations have put in place, or are considering, mandates compelling fuel producers to use a certain percentage of SAFs. These would effectively enforce greater production of the fuels.

Norway, for example, has required at least 0.5% of advanced biofuel to be mixed with jet fuel sold since January 2020, with the aim of increasing use of SAF to 30 % of aviation fuel by 2030. France has set an objective of incorporating 1% of SAF in each flight departing from France in 2022, and 2% in 2025.

The challenge involved in reaching anything approaching a significant contribution towards lowering CO2 2 emissions is obvious. It is, however, a challenge that the industry must meet if it is to continue to thrive.

Shell Aviation

Shell Aviation